Blog post content goes here

Q3 | 2025 SUMMARY

When reviewing Squamish’s real estate activity over the first three quarters of 2025, one word comes to mind: inconsistent. This roller coaster performance can be attributed to several factors — higher interest rates at the beginning of the year, the impact of U.S. tariff policies that contributed to broader economic uncertainty, ongoing labour unrest at multiple levels (nationally with the Canada Post and Air Canada strikes, provincially among public service workers, and locally with the District of Squamish employees), and a weaker Canadian dollar that has put a strain on the overall cost of everyday goods. Together, these conditions have caused both buyers and sellers to carefully evaluate their real estate decisions and weigh all available options before moving forward.

BRIEF SQUAMISH MARKET OVERVIEW

Two key factors have distinguished the Squamish real estate market this year: sales are up year-over-year, and prices have continued to rise modestly throughout 2025. Listing inventory has remained within a typical range for this smaller market—generally on the lower side—and days on market have declined compared to the past two years. This suggests that buyers are ready to act quickly when the right property becomes available

Two key factors have distinguished the Squamish real estate market this year: sales are up year-over-year, and prices have continued to rise modestly throughout 2025. Listing inventory has remained within a typical range for this smaller market—generally on the lower side—and days on market have declined compared to the past two years. This suggests that buyers are ready to act quickly when the right property becomes available

SQUAMISH MARKET ACTIVITY

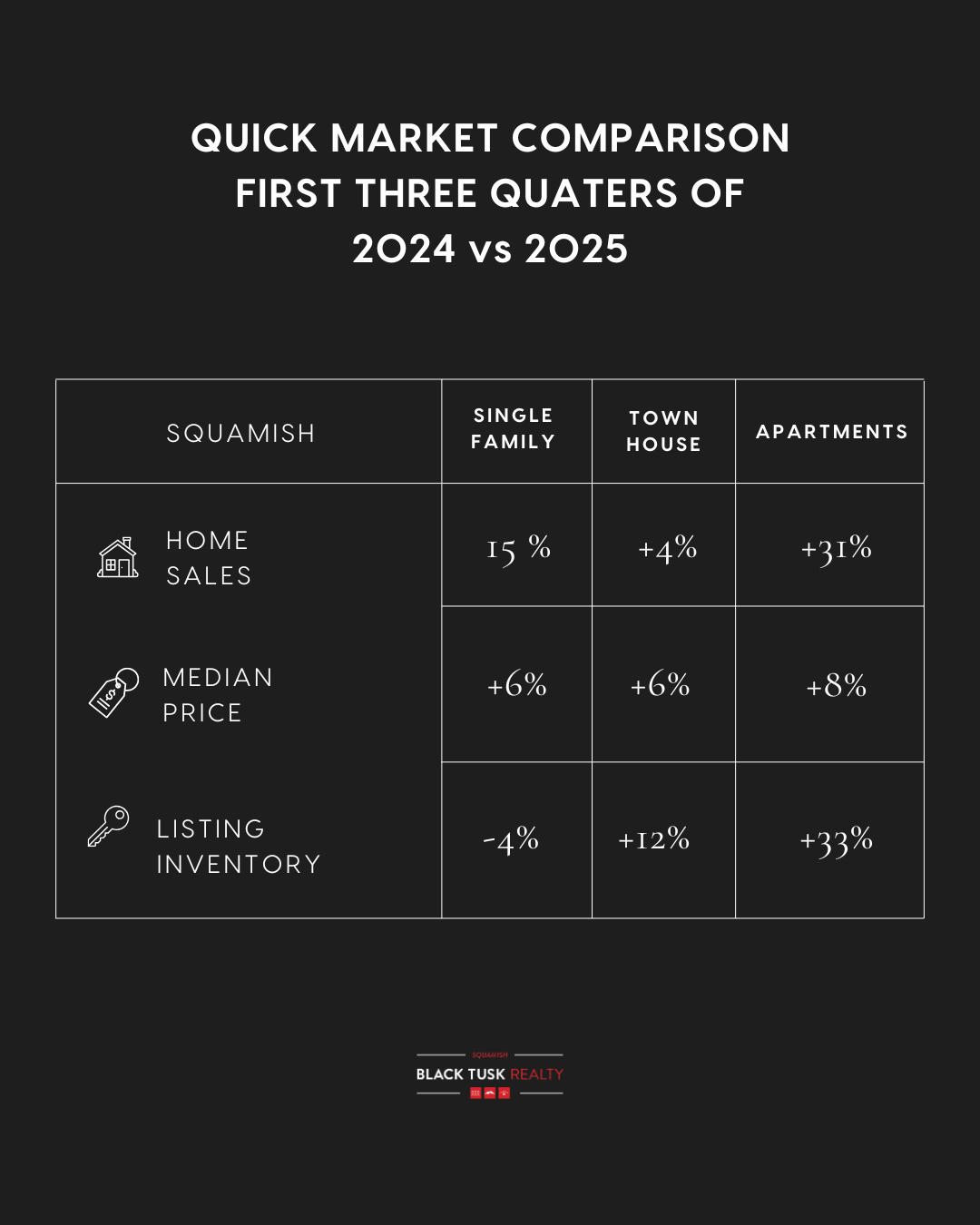

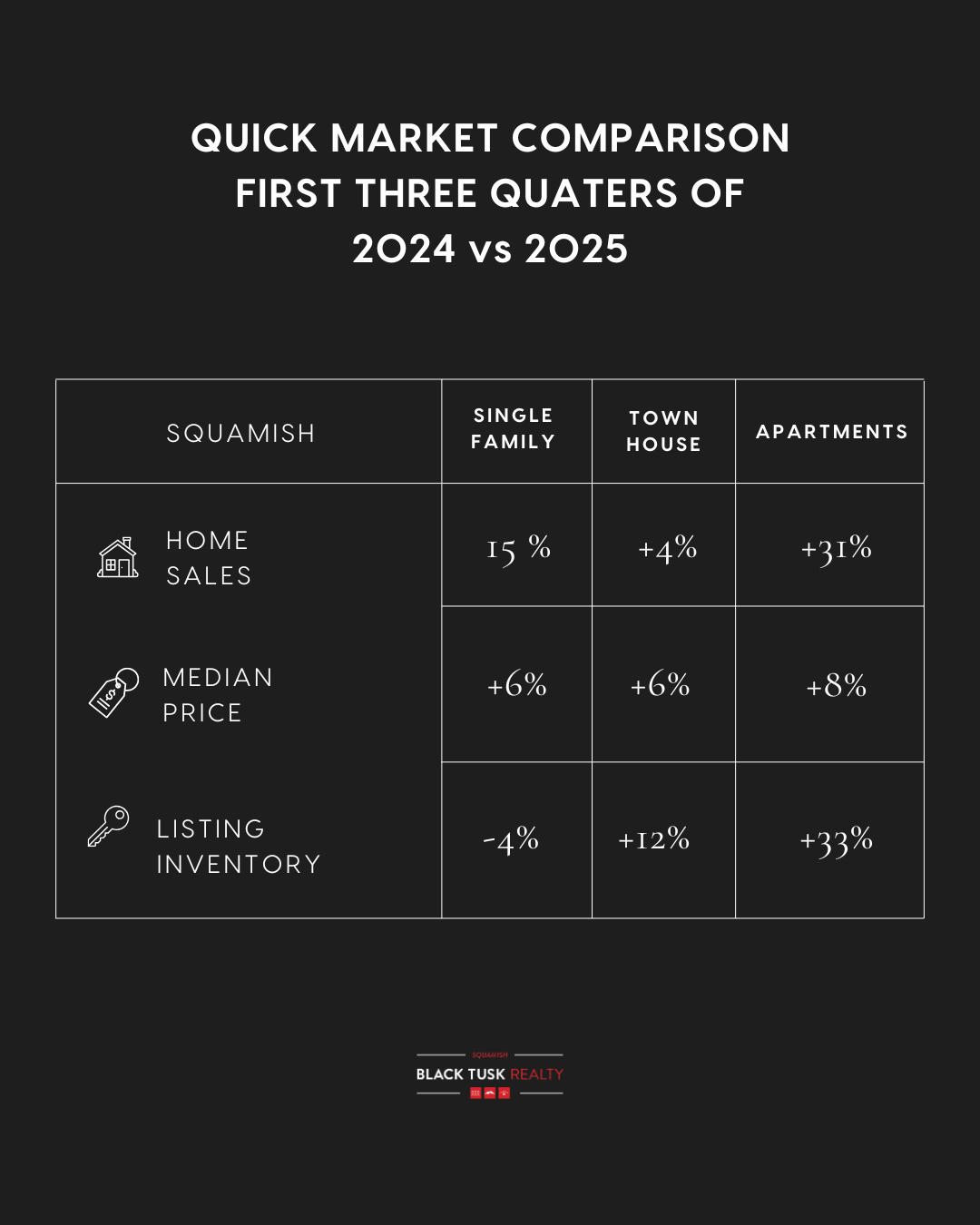

When comparing year-over-year sales data, all three residential segments in Squamish have seen gains:

Single-Family Homes: Inventory is down 4% year-over-year, while the median sale price increased 6%—from $1.56M to $1.67M—marking a 15% overall rise in home values this year. This segment remains the most sought-after in the Squamish market.

Single-Family Homes: Inventory is down 4% year-over-year, while the median sale price increased 6%—from $1.56M to $1.67M—marking a 15% overall rise in home values this year. This segment remains the most sought-after in the Squamish market.

Townhomes: Sales were up slightly by 4%, with the median sales price also increasing by 6%. Inventory rose by a modest 12%, though most of that increase occurred within the past few weeks—a typical seasonal trend for this segment.

Apartments: Sales climbed 31%, running counter to trends in much of the province and across Canada, where many regions face an oversupply of unsold, newly constructed condos. Median prices rose by 8%, and while listing inventory increased 33% year-over-year, overall numbers could signal a shift toward a more buyer-favouring market heading into the final quarter.

LOOKING AHEAD

According to the British Columbia Real Estate Association (BCREA), “Home sales in the province are gaining momentum following a slow first half of 2025,” said BCREA Chief Economist, Brendon Ogmundson. “We anticipate sales will finish the year strong, aided by lower interest rates helping to unleash pent-up demand.” Squamish continues to outperform much of the province, showing stronger sales activity despite limited supply. This heightened demand will keep buyers under pressure to move quickly when homes that meet their needs come to market. With the Bank of Canada’s next interest rate announcement scheduled for October 29th, many analysts are anticipating another rate drop. Such a move would enhance buyer purchasing power and, more importantly, restore a sense of certainty as we head into the final quarter of 2025.

FINAL THOUGHTS

Now is an excellent time to connect with your financial institution or mortgage broker to determine your purchasing limits and be ready to act when the right property becomes available.